Why M&S’s move to re-target family age consumers is the toughest task possible

In announcing M&S’s full year results today, CEO Steve Rowe has vowed to appeal more to family-age customers in clothing and home as part of the answer to its stagnant turnover, sagging profits and average customer that is heading steadily north of 50. In doing so, M&S is heading straight back into the thick of a commercial battleground that is already flowing with red ink for those retailers getting it wrong.

The problem is that while this is a large audience, since M&S lost its footing in this territory, things have changed in a way that make it very difficult for it to make its way back in. The middle ground it used to operate in is dominated by Next, which specializes in this area and is not going to give way easily. Below it sits the low-price colossus Primark, and above it are a whole range of successful lifestyle brands like Joules, Boden and Fat Face who have nailed the middle class family casual wear market.

And as a whole, the market they are targeting is not getting any easier. Looking at clothing & footwear first, the heat map of spending share changes in the past five years shows that the previously dominant wealthy family market is showing up blue (i.e. shrinking share of spend), while the ‘hottest’ area in terms of growth is the fourth quintile (upper middle income) 65+ household.

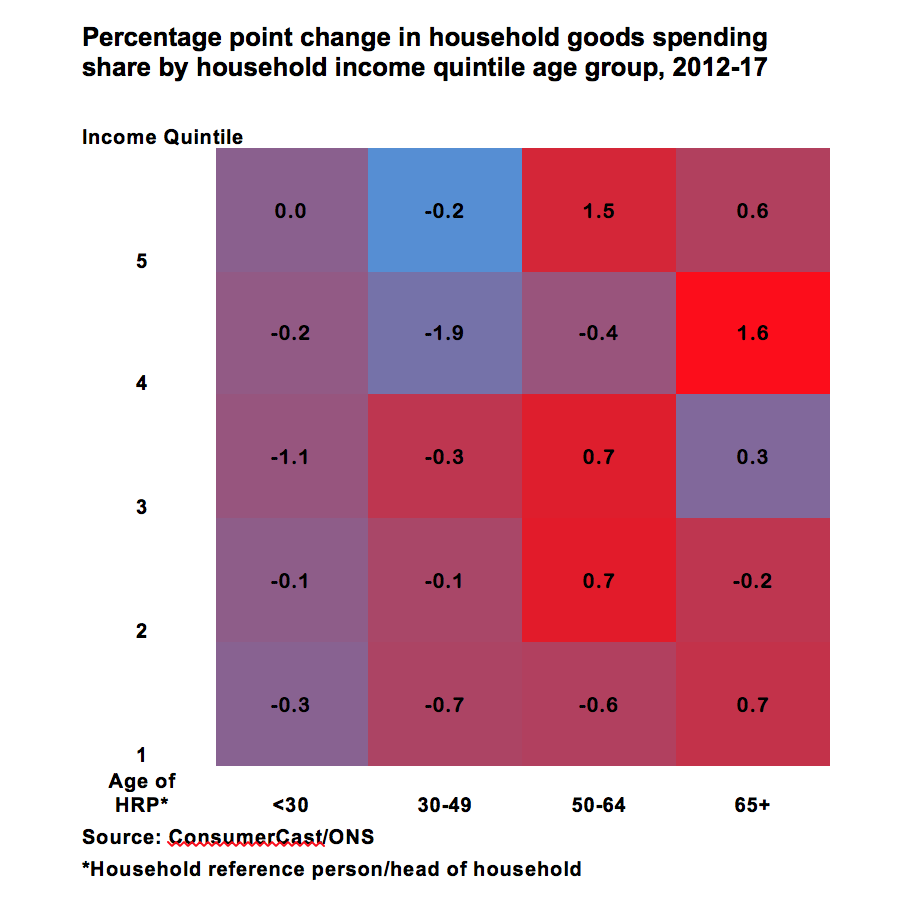

Nor is the home goods market any more reassuring. It shows a very similar pattern to that for clothing, with the added complexity that top 20% (fifth income quintile) 50-64s are also a big growth area.

As a strategic objective, reconnecting with its lost family-age clothing and home customer base is an important one for M&S, but it will face a ferocious struggle against entrenched competitors in a shrinking segment of the market. The prospects for success are, it has to be said, rather slim.