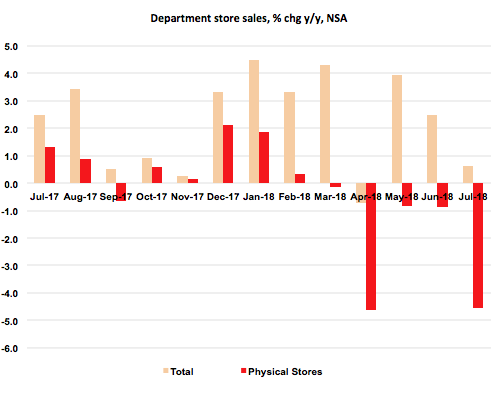

Why department stores are in deep trouble, in one chart

Source: ONS, ConsumerCast

The department store as a retail format is in deep, deep trouble. The fate of House of Fraser, rescued for £90m by Sports Direct owner Mike Ashley after being put into administration, as well as the recent profit warnings at John Lewis and Debenhams (the third this year), are proof of this. But why have the problems facing them become so critical now?

Since the beginning of this year, sales through their stores have fallen off a cliff. They have declined for five months in a row and were down by nearly five per cent in both April and July. This would be bad enough on its own. But with costs of everything from staff to business rates and merchandise rocketing, and profit margins, particularly at House of Fraser, already thin, the trading situation has knocked a whole load of extra nails in the coffin of department store retailing on the high street.

The irony is that, on a total basis, they are not performing that badly, with sales up 2.2% in the past year – not spectacular but not catastrophic either – driven entirely by online sales growth. However, with a high fixed cost base in stores and online facing extra costs ranging from fulfilment to customer recruitment, the net effect on profitability for department stores has been especially damaging.

Furthermore, there is little prospect of rapid growth in consumer spending to come to the sector’s aid. Discretionary spending is being dampened again by food and petrol price inflation and households are busy adjusting for a long period in 2016 and 2017 when they spent ahead of net income growth, suppressing expenditure until at least next year.

Is there any hope for the sector? Well, not without some painful and far-reaching surgery to their property portfolios, which is at the heart of their malaise in terms of costs. At the same time, they need a fundamental shakeup in their product offer to answer the question: why shop with us online/in our stores and not with pureplay operators? Own and exclusive labels, tip top environments with great service and exclusive experiences (not just copycat rollouts of high street casual restaurant chains) are all going to be part of this. If, and only if, department stores tackle the scale of change needed then they will survive, but otherwise they face a swift and nasty commercial death.