The UK household squeeze may already be over, but a bumper Christmas doesn’t look likely

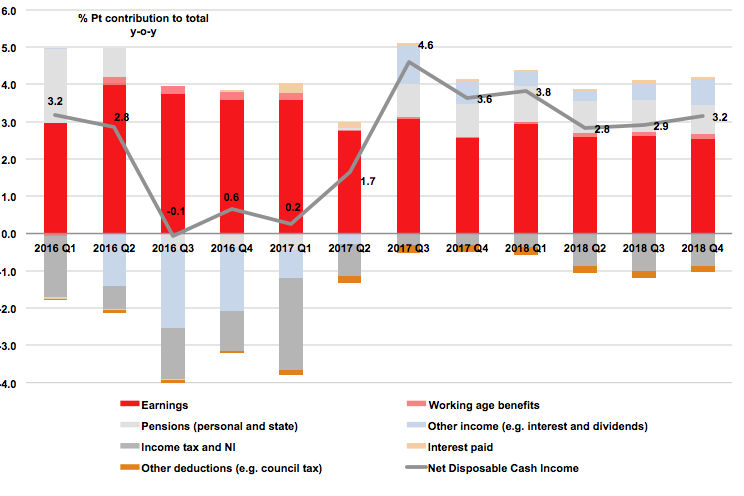

UK consumers have just been through a pretty nasty squeeze on their net incomes in the past year. Not only has wage growth been stagnant, but they have also paid a lot more tax and national insurance and inflation has taken off. On top of that, in 2015 many self-employed people took extra dividends out of their companies to avoid tax increases in 2016, while many also took advantage of the new pensions freedom to withdraw cash from their pension funds. After the income ‘feast’ of 2015, there was a corresponding ‘famine’ in 2016. The result has been to crush household net income growth for the last 12 months.

So far, so bad. However, with the jobs market showing continued rises in employment and hours worked, plus a tiny uptick in wage growth, coupled with slower growth in tax and NI payments and a normalisation of dividend and pension income, could mean that the last quarter up to the end of September was the best since 2015. Despite all the talk of living standards falling, with inflation now at 3.0%, it is possible that real household income eked out a rise.

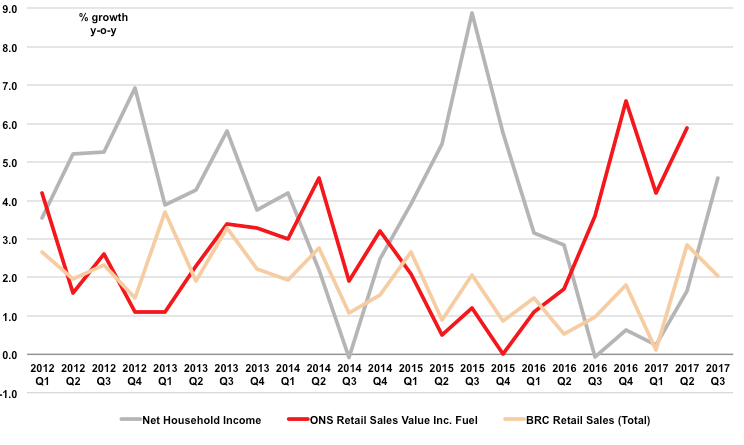

Does this mean relief for retailers and consumer-facing brands in the run up to Christmas 2017? Well, probably not. This is because when they get a boost from income growth, households don’t immediately go out and spend it. As the second chart shows, a big spike in incomes in 2015 was accompanied by virtually zero growth in retail sales, while a slump in growth in 2016 showed a continued lack of increase according to the BRC but a boom according to the Office for National Statistics. In the fourth quarter of this year, household net incomes will probably have risen by just 4.2% compared with two years earlier, while according to the ONS consumers splurged last Christmas quarter, with retail sales up 6.6%. This suggests retailers will struggle to tempt spending out of households that over-reached themselves last festive season. In contrast, the BRC showed growth of 1.8% in 2016 Q4, meaning there could be just over 2% of extra spending power growth for households to play with.

With the Bank of England chairman Mark Carney tipping inflation to peak before the end of the year, there are some signs of the pressure on households easing off, but it’s certainly not time to be toasting the prospect of a bumper Christmas season.