The sudden squeeze on 30-49s that may have cost the Tories the election

Among the findings of those raking over the psephological coals of the UK General Election result was the fact that the biggest swing to Labour happened among the 25-34s, with a general move to Jeremy Corbyn’s party among the under-44s, while the over-55s swung to the Conservatives.

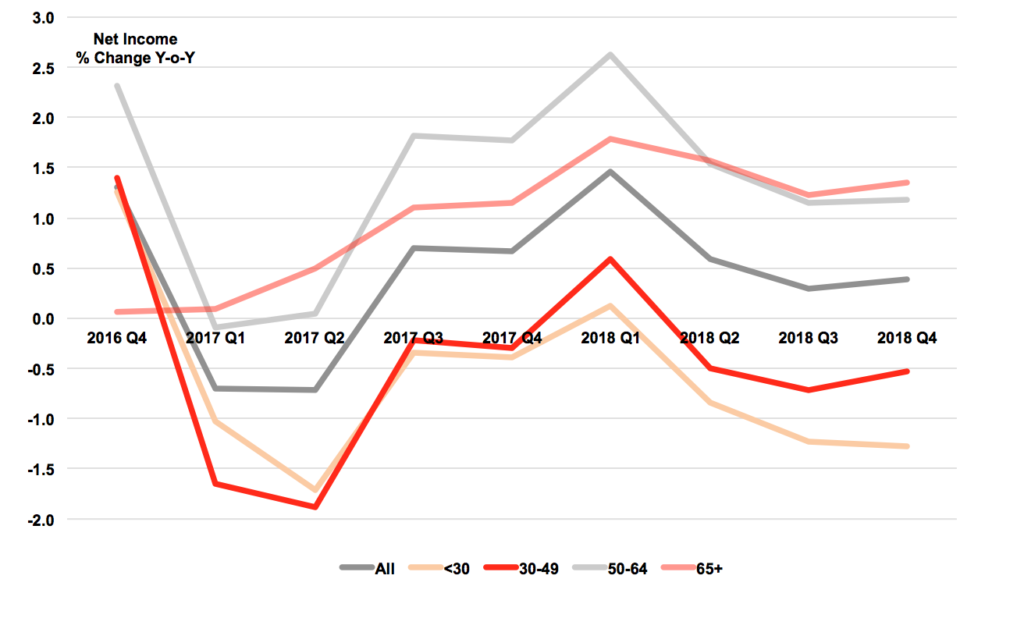

Meanwhile, it is no coincidence then that the first quarter of 2017 marked a big slump in real net incomes for both the under-30s, who voted overwhelmingly for Labour, and to an even greater extent, the 30-49s. This sudden and intense squeeze on real incomes, caused by leaping inflation and slowing wage growth, coupled with much higher payments of income tax and national insurance as well as benefit cuts, worsened in the second quarter, with 30-49s seeing net real income fall by nearly 2% year-on-year. Contrast that with the 65+ group, who actually saw their living standards continue to rise marginally and the 50-64s, who saw only a marginal fall in 2017 Q1, followed by a small recovery in Q2. It is therefore little wonder that many under-50s turned tail from the Conservatives and fled to a party that seemed to offer relief from economic pressure.

Just as with voting patterns, this divergence in economic fortunes will also be played out across the retail sector in the next 18 months. Following the predictions of the Office for Budget Responsibility, household net income growth is set to recover later in 2017 as the leap in tax payments last year is not repeated this year, boosting households’ take home pay growth rates. This will allow a small recovery for 30-49s at the beginning of 2018 (and a truly tiny one for the under-30s) and a much bigger one for 50-64s, starting in the second half of this year.

What happens to spending depends mostly on the unemployment figures. If they keep on falling or stabilise at their historically low level of 4.6%, then households will carry on spending and borrowing pretty much as before, although with the under-50s cutting back marginally. Any rise in unemployment will change households’ outlook and force them to pull in their horns. The only beneficiaries in the under-50s market will be those retailers who benefit from trading down, particularly the German budget grocers and pound stores. Anyone caught in the middle market serving the under-50s is likely to be particularly hard-hit. Retailers should keep on watching the jobs market figures for the rest of 2017 and into 2018, because it is those that will in large part determine their fate.