Slowing online spend is hitting retail growth: could ‘Brexit jitters’ finally be happening?

‘Brexit jitters’ have been a recurring theme for retail commentators over the last three years, brought into play just as persistently as the official figures have refused actually to show any evidence that they really exist. June seems to be no different, with ONS retail sales up 4.0% on last year (unadjusted, excluding petrol), bouncing back from a disappointing May.

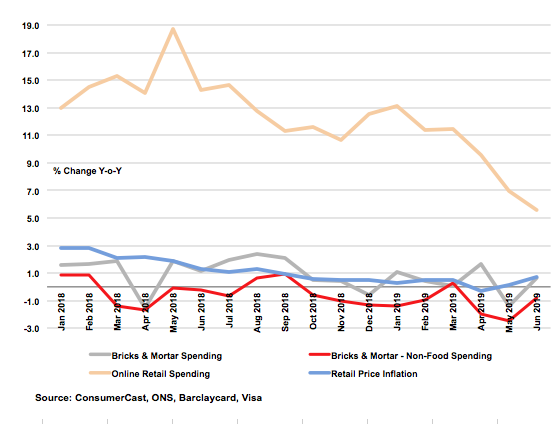

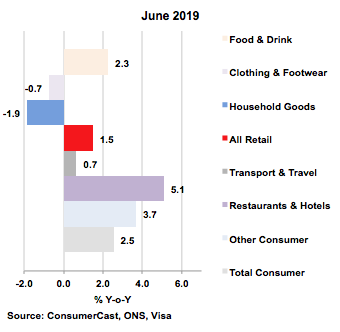

ConsumerCast’s modified data, incorporating other data sources (including Visa figures), show a more downbeat picture. Not only is physical store non-food retailing still deep in recession, with a 0.8% fall in sales even before accounting for inflation, but now online growth has slumped, to just 5.5%. We knew shoppers were turning away from the high street, but now they’re apparently holding back from buying on their mobiles, tablets and computers too. The only exception appears to be in hotels and restaurants, where spend growth continues to defy expectations by powering on regardless.

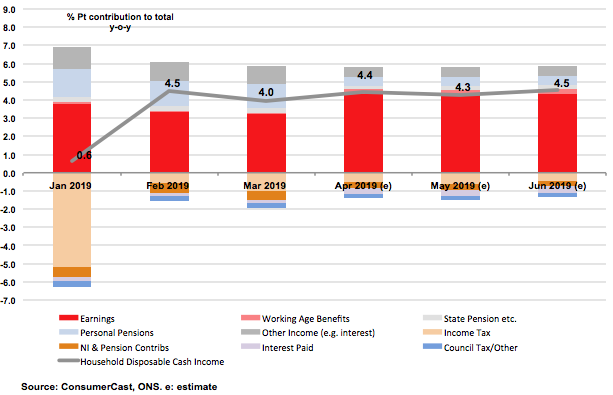

This weakness cannot be blamed on a slowdown in household income growth. As ConsumerCast’s figures show, after a very poor January, due to big jump in tax paid, it has resumed a steady, strong growth, hitting 4.5% in June.

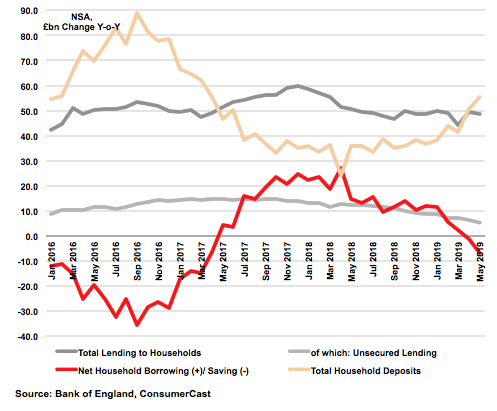

What is happening, as shown up in the Bank of England’s monthly money and credit figures (only available up to May), is that households are finally holding more money in their bank and savings accounts and are borrowing less. In the past, they have done this for one of two reasons: either unemployment is rising and they start fearing for jobs and employment income and decide to rein in their finances, or they have received an unexpected boost to growth in income and don’t expect this to be repeated. Neither of these is currently the case, with the jobs market remaining strong and income growth steady. The only conclusion is that the UK’s shoppers really are holding onto their purses and wallets for another reason, the most likely candidate being fears over the impact of Brexit.

What does this mean? Sadly, even more short term pressure on the retail sector, particularly those with a big exposure to physical stores. So there will be no relief for Arcadia, the department stores and all the others suffering from the high street slump. The only silver lining is that it means UK consumers are finally living within their incomes and reinforcing their finances, which should make them less vulnerable should anything really bad happen in future.