September’s online slowdown poses extra danger for Christmas trading

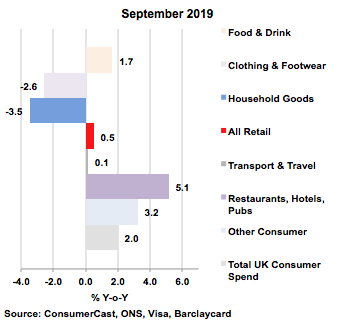

A mild start to September and continued nervousness among UK consumers held back spending once again last month. Fashion and home goods bore the brunt, the latter most affected by reluctance to make big ticket purchases, but as usual, spending on restaurants, hotels and bars rode out the storm, up by over 5% year-on-year. Despite net household incomes rising by 4.2% on last year, September consumer spending was up by just 2.0% in total, meaning a big rise in saving/fall in borrowing compared with 2018.

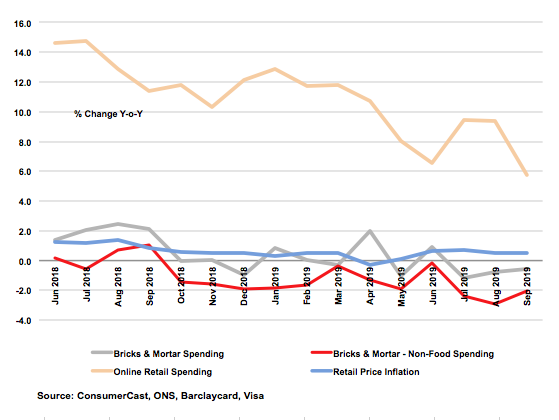

The biggest contribution to the downturn in spending growth has come from online, which has seen its growth rate halve in the past year to 5.8%. How major online retailers react to this slowdown will set the trading pace for Christmas 2019 in non-food. If they start missing sales targets set in previous boom times, they are likely to turn to increased discounting and delivery-based incentives to boost their top lines, ramping the pressure on already beleaguered predominantly physical retailers to discount sooner and deeper than planned. As a result, Black Friday is likely to be only one of many tactical trading worries retailers face in the run-up to Christmas 2019. Not to mention, of course any fallout from current political events.