Rising interest rates may actually be good news for (older) consumers

Rising interest rates has been the dog that has persistently failed to bark as far as the UK consumer economy has been concerned since the recovery from the great financial crisis started in 2010. And now the dog has, if not barked, at least yelped in the form of a tiny 0.25% point rise in the Bank of England base rate, the first in a decade.

With nearly half of mortgages being fixed rate, the pass-through in the short term will be limited to those with standard variable or tracker mortgages. At the same time, some banks and building societies have reacted immediately to change their savings rates and this can be expected to filter through to others as savings market competition takes effect.

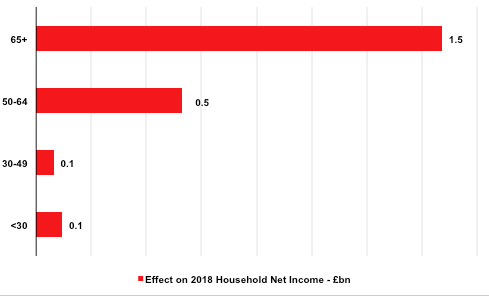

Based on a full pass-though on savings rates and a limited first year effect on mortgage interest, ConsumerCast estimates the move could add £2.2bn in net income to households in 2018, with virtually no net benefit for under-50s but an extra £0.5bn for 50-64s and £1.5bn a year for 65+ households.

While this is good news for the UK consumer economy overall, it will further intensify the divide between older and younger households, boosting the 65+ group who are the ones least in need of it right now.