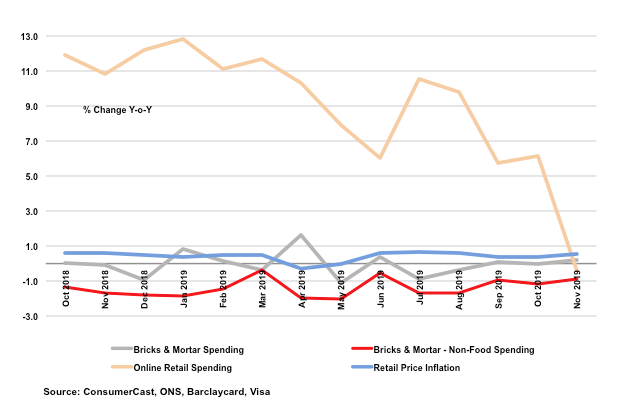

Online plunges into decline in November as consumer spending stagnates

The consumer spending story changed dramatically in November. While previously online had been the one bright spot in a progressively gloomier consumer scenario, in November it too joined physical retail in suffering stagnation or even outright decline, with a year-on-year fall of 0.4%. While food and drink held out for physical retail, with a rise of 1.7%, the poor performance of both clothing and footwear and household goods meant overall retail barely grew (up just 0.1%). Transport and travel budgets were cut back as consumers made the most of cheaper petrol but continued to buy fewer cars. Only restaurants, hotels and pubs continued to outperform, up 4.7%, led more by drinks sales than by eating out.

What can we put this online decline down to? First of all, online is not immune to general trends in spending and it has big exposure to both severely underperforming categories – clothing and footwear and household goods. Secondly, the pace of innovation in terms of delivery and customer service had been blistering for some time and more recently, perhaps it has become harder and harder to deliver further improvements in convenience and speed for this channel.

The weakening of the overall spending climate has been driven by two factors: net income growth for households slumped this summer (only 1.9% in August according to ConsumerCast estimates) for a number of reasons, including lower personal pension payments and a slowing labour market. Add this to general nervousness about the political situation (who might be leading the country and where they might be leading it) and the torrential rainfall this autumn and the fact that overall expenditure is stagnant is hardly surprising.