Household income squeeze ‘about to end’? Actually it happened last year

If you read the national newspapers, February saw UK households pass a landmark in terms of living standards, with an end to the fall that started in 2016, as average wage rises finally crept above inflation. The BBC was even more grudging, saying that on a three month rolling average, the real wage squeeze was still there but ‘nearing an end’.

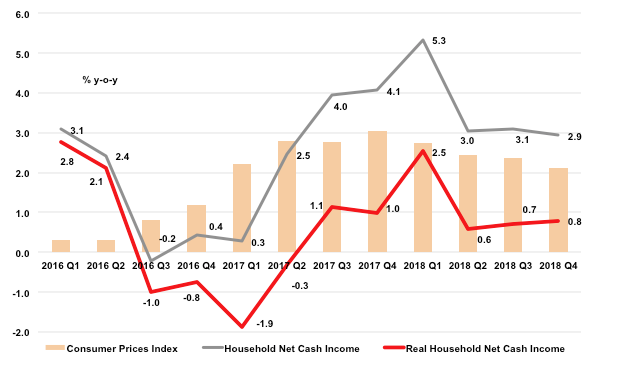

The problem that this commentary fails to deal with is that wages are only one element of what makes up living standards. If you take into account taxes paid, income from dividends, pensions etc, then they are actually way behind the curve. After a nasty squeeze in 2016 and early 2017, as the chart below shows, although it may not feel like it for many, living standards in terms of net real income have actually been rising since last summer.

This is great news, surely, for a retail and consumer sector that has been suffering a wave of bankruptcies, store and restaurant closures. It must mean that UK households are about to splurge even more, mustn’t it? Well no, not really. The problem is they have already been spending way in advance of the rise in their income for the past 18 months and have been running down the amount they add to bank balances and deposits to keep the consumer gravy train going. It is likely to be the end of 2018 or early 2019 before household income has recovered enough for consumer finances to be on an even keel. So until that time further retail restructuring, cost cuts, branch closures and redundancies look inevitable.

Source: ConsumerCast, ONS, OBR