Grocery polarisation that may be driving Tesco’s budget chain plan

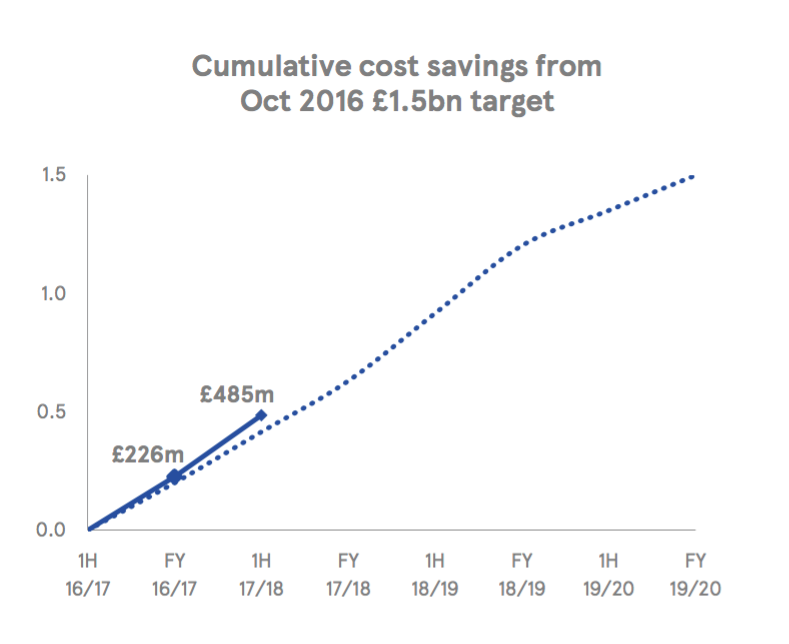

Tesco’s reported plans to set up a budget chain to rival Aldi and Lidl seem like the result of some counsel of despair within the grocer’s management. Almost all of the profit improvement in the core UK business in the last year has been driven by cost cuts as it strains to reach its 3.5% to 4.0% operating margin target by 2019/20. It has only just started on its £1.5bn cost reduction plan, with the bulk of the heavy lifting yet to be done, as this chart from its 2017/18 interims shows.

These cuts were due to come three main sources: first and foremost store operations, followed by goods not for resale and finally logistics and distribution. From here on in, this process can only become harder and harder with existing business structures. Presumably this is one of the key drivers behind the move to look at different business models entirely.

Another influence may be the way in which the grocery market is moving. As the heat map below of growth in spending on food and non-alcoholic drink in the past five years shows, it is polarising. In the last five years, the fastest increases have come among top income bracket over-50s, particularly from the 65+ group, and among lower middle income families and the poorest over-50s. This has played into the hands of M&S and Waitrose who attract customers at the wealthier, older end of the market on non-price factors like quality of own label and fresh ranges and service, and the budget players, led by Aldi and Lidl, as well as to Morrisons, which still attracts an older audience, who are attracting more financially-stretched shoppers buying predominantly on price.

The biggest segments in this heat map in terms of total spend are actually the top and upper middle 30-49s, prosperous young families who account for a quarter of food spending. They have seen very little increase in the past five years. So an audience that was previously courted by both Tesco and Sainsbury’s as core to their businesses is no longer a source of potential growth. This is clearly a strategic nightmare and may be prompting all kinds of questions about who Tesco wants to target in future.

However, rather than being distracted by a potentially disastrous sideshow, Tesco should focus on continuing the rebuild of its core brand, using it as a vehicle to take the fight to the budget grocers, instead of wasting years and hundreds of millions of pounds on a risky new venture. As long as it keeps on improving on essential choice factors like quality and availability, the Tesco brand still has enough ‘stretch’ to attract diverse customer groups. The key problem is that Tesco’s profit margin objectives are probably not achievable in a mature, highly competitive market like the UK where consumers are highly price sensitive and face potentially years of slow growth in living standards. Cutting costs too drastically could threaten non-price objectives and put this broad-based appeal in jeopardy.

Photo: Tesco