Four reasons why Christmas 2018 maybe wasn’t so bad for retail after all

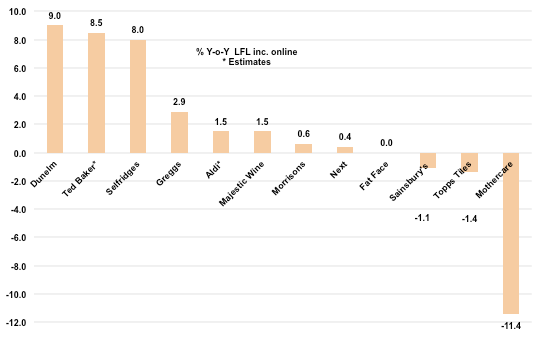

2018 Christmas period trading. (Note: Selfridges covers first 24 days of December only)

Despite reports of tumbling consumer confidence, Brexit “jitters” and the “worst November on the high street ever” (from the Anti-Claus, Sports Direct owner Mike Ashley), Christmas trading doesn’t really seem to be have been that bad after all. There have been no profit warnings (so far), one dreadful performance (Mothercare) and a couple of poor ones (Sainsbury’s and Topps Tiles, the latter against strong comparatives). By contrast Dunelm, Ted Baker, Selfridges and Greggs were very good, as was Joules (although with no like-for-like figures to compare).

Certainly it won’t be a vintage festive season, and there are still some major retailers (Debenhams, M&S, Tesco, Asda) to unveil their results, but all in all, the worst case scenario of a consumer meltdown seems to have been largely avoided. So why was armageddon apparently cancelled?

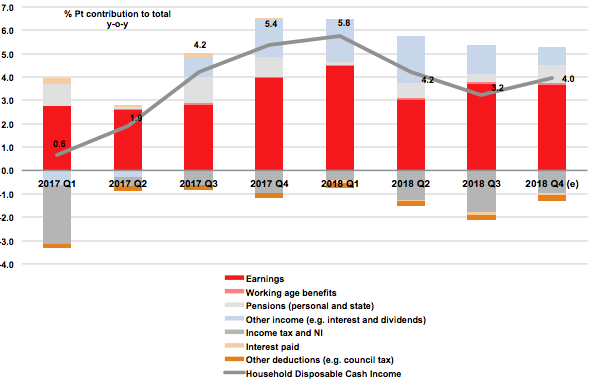

1) Household net income (above) is rising rather strongly. The strong growth in spring was actually even better than first thought and there was a further upturn in autumn, led by rising wages in a buoyant jobs market;

2) Consumers are still increasing their borrowing, even if unsecured debt levels are rising more slowly than before, and more importantly, they haven’t been spooked into saving more;

3) Confidence, while lower than it was, is still not low by historic standards; so forget the “jittery” consumer theory;

4) Inflation is now falling, helped particularly in December by petrol price cuts.

Looking forward to the rest of 2019, the best that can be said is that UK households go into the new year with a financial position that is, if anything, strengthening. The main recommendation is to ignore volatile consumer “confidence” indicators and focus on what is happening in the real world of prices, wages and jobs as a guide to behaviour. If these remain strong, then retailers should be reasonably confident, but if these indicators start to go haywire, then it’s time to take cover.