‘Experience’ spending isn’t the problem for under-50s: it’s basic living costs

While Next has just heaved a small sigh of relief that its Christmas trading was not as bad as feared, mainly due to favourable weather patterns, it also warned that it was expecting subdued consumer demand for clothing, driven by the increase in spending on ‘experiences’.

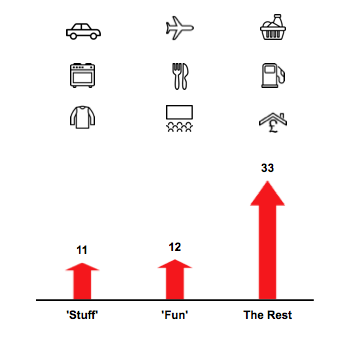

It may be true that overall the growth of ‘experience’ spending on areas like travel, restaurants and leisure generally has had a major impact on the consumer economy, but that does not mean it is the case for all age groups. For the under-50s, on whom Next is almost totally focused, the pattern of spending change has been quite different from that of the over-50s. As figures from the latest ConsumerCast report (2018 UK Consumer Opportunities: the Under-50s) show, spending by this age bracket on ‘experiences’ or ‘fun’ has gone up by £12bn a year, while their spend on consumer goods or ‘stuff’ has gone up by £11bn a year. These figures might suggest that Next is right in blaming ‘experiences’ for putting pressure on the clothing market. However, at the same time, expenditure on other areas, mostly basic living costs like food, petrol, housing (particularly rent) has rocketed by £33bn a year, dwarfing growth in ‘stuff’ and ‘fun’.

Change in consumer spend per year by under-50s households, £bn, 2011-16

Source: ConsumerCast, Office for National Statistics

So what does this mean? If you are focused on the under-50s and, like Next and Debenhams, are starting to bring in cafés, gyms, hair and beauty salons etc. into your stores to attract more spending from exactly the same audience, you might eke out some extra turnover. But it is not going to save you from the core, fundamental problem: the under-50s are under severe economic pressure and is not where most spending growth, if there is any, is going to come from in the next few years.