Election nerves and extra saving tarnished retail’s ‘golden quarter’

As the results for retail’s ‘golden quarter’ roll in, a subdued, downbeat picture is emerging. The major grocers had a tough time, with a stagnant market and the German budget players Aldi and Lidl snapping up more market share. Non-food looks pretty bad overall, with Sainsbury’s general merchandise business including Argos seeing falling sales and poor trading at John Lewis, with like-for-like sales down 2%, led by electrical and home. The positive performance at Next is almost certain to be the exception rather than the rule.

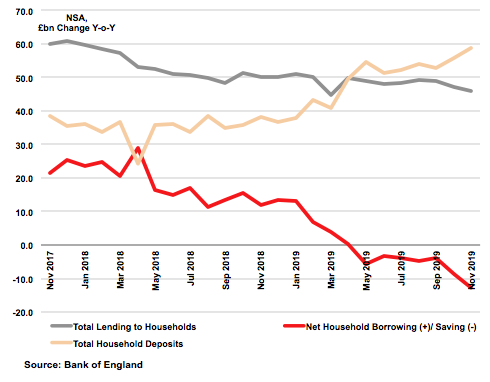

November in particular was hit by households’ jitters in the run-up to the December 12 general election. According to Bank of England figures for the month, they stuffed an extra £10bn into their bank and savings accounts during the month and borrowed an extra £5bn, giving net saving of £5bn. In November 2018, this net saving figure was just under £1bn. So an extra £4bn was saved in November 2019 compared with the same month the previous year. When you compare this with total consumer spending of £91bn during the month and retail spend of £39bn, this burst of pre-election saving is the prime candidate for the Grinch that stole retail’s Christmas.

Taken over the whole year to November, an extra £25bn of net savings were made compared with the previous 12 months. That is a massive shift in households’ propensity to save and borrow, taking around 2.4% out of total annual consumer spending of £1.1trn, almost certainly concentrated among those who can afford to save more rather than to splurge i.e. the more affluent. The scrimping took several forms, including trading down to budget operators (groceries), seeking out Black Friday bargains (non-foods generally) and holding back on big ticket items (home and electrical).

We have yet to see whether there was some kind of respite from this in the few days after the election in the run up to Christmas. Whatever happened, it was probably too late to save the season’s trading. Retailers will have to work hard in the coming year to prise open consumers’ wallets and purses in 2020 after the end of 2019 saw them snapped shut in a very determined way. The only consolation is that as things stand, the money is still there for them to spend – if they really want to.