Don’t bother with consumer ‘optimism’ as a guide to the future – it simply tells us what’s happening now

In the wake of the general election, political uncertainty reigns and that’s taking its toll on consumer optimism, boding ill for spending – or at least that’s what this week’s headlines have been telling us. Except it’s nonsense, at least in its most literal interpretation: that what people are going to spend in the future can be affected directly by what’s going on in the Westminster political bubble.

The headlines were sparked by the finding that the long-running and respected GfK UK Consumer Confidence Index had dropped five points in June to minus 10, from minus five in May. GfK warned of “widespread fears of Brexit-induced economic slowdown”. Gosh, minus 10 sounds really low. After all, as GfK pointed out, that is just two points away from the post-referendum low of minus 12.

However, let’s put this in the wider context. Even in the two boom years running up to the financial crisis, 2006 and 2007, the index averaged minus six and at the height of the recession it plunged to minus 36. So in historical terms, consumers really aren’t that fearful, despite GfK’s attempts to dress it up otherwise.

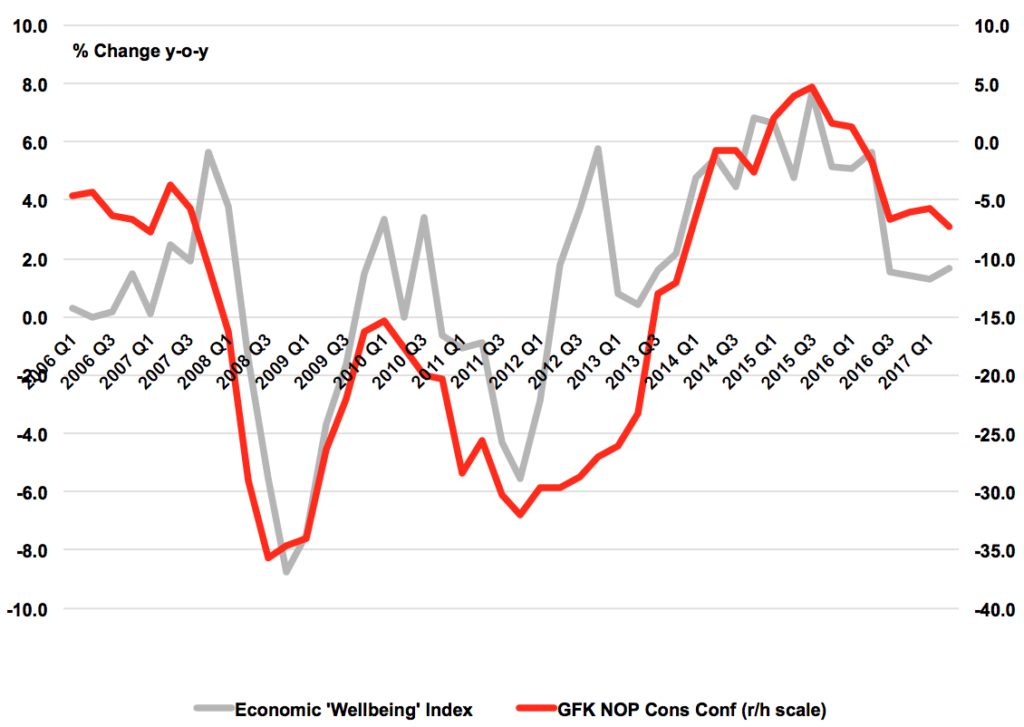

Secondly, the figures really have little predictive value, rather reflecting what’s going on in the real world, right now. Why do I think this? Well, look at GfK’s index compared with a real world ‘wellbeing index’. This comprises ConsumerCast’s calculation of net household income (after taxes and interest payments) adjusted for consumer inflation (the CPIH index), minus 3.5 times the percentage point change in unemployment in the last year. It’s pretty clear that apart from the initial plunge into recession in 2007, preceded by dire reports about the growing financial crisis, and the 2012 Olympics mini-boom, the turning points in the two indices are very similar, particularly the current slowdown that started in 2015 Q3. ‘Optimism’ therefore is merely a reactive measure of what is going on at present and on its own is no guide to the future.

So does this mean we can ignore ‘optimism’ and say everything’s OK with the UK consumer? The answer is clearly “no”. Real incomes are under a very big squeeze, particularly for under-50s households, who are in outright recession right now. What is sustaining the situation from going into complete meltdown, however, is the falling savings ratio, as was made clear in the ONS figures for the first quarter. This is being driven by the other big component in the ‘optimism’ equation – the unemployment rate. This remains low and falling, giving consumers confidence that if they borrow, they will at least hold onto their jobs and be able to keep up with repayments. As always, the unemployment figures are a big pointer to what’s really going to happen to spending and the next ones are due out on 12 July. If they remain good, then many retailers can heave a small sigh of relief. If they’re bad, then watch out for a significant worsening of conditions in the second half of 2017.