Are UK consumers really holding back because of ‘weak sentiment’?

Another day, another retailer claiming ‘weak sentiment’ or ‘uncertainty’ or ‘low confidence’ among UK consumers as a cause of their poor performance. Today it is Bonmarché. A couple of weeks ago it was John Lewis Partnership. All of them are basing their arguments on the received idea that UK consumers somehow look into their crystal ball for the UK’s future and their household finances, don’t like what they see and hold back on spending accordingly. But where’s the evidence that this is the case?

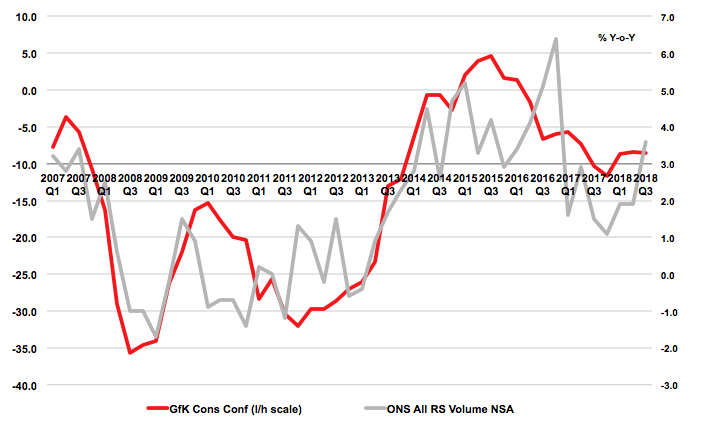

Not according to the indicators of ‘confidence’ themselves. Looking at the long-running GfK Consumer Confidence Index, UK consumers are pretty much as confident as they were way back before the financial crisis. As has been observed on this blog before, ‘confidence’ is not an indicator of future behaviour but a measure of sentiment in the here-and-now. Variations in ‘confidence’ are in fact directly reflected the quantity (volume) of consumer spending, as seen below:

Sales volumes for retail as a whole in July and August were up by 3.6% year-on-year, which is reasonably strong positive growth. The effect of the hot weather was very mixed and probably shifted spending between categories and channels more than boosting it significantly overall. What was more likely was that improved household financial conditions lifted growth from its earlier low point.

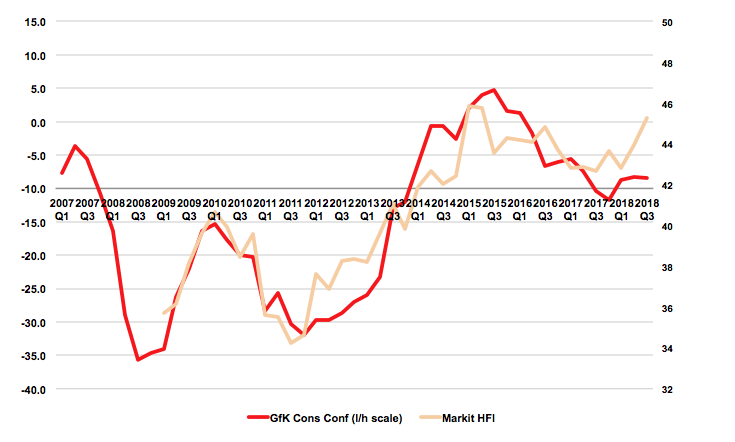

As further evidence that consumer ‘confidence’ is actually about what’s happening now, not expectations for the future, look at how closely GfK moves in line with another major measure, the Markit Household Finance Index (HFI). This is meant to measure households’ view of their finances as they stand at present. In statistical terms, the correlation is 92%. Note also how, although below the 50.0 dividing line supposed to show things getting neither better nor worse, the HFI is close to matching its best previous quarterly average, seen at the start of 2015.

The main conclusions here are that:

1) No UK consumers aren’t really ‘uncertain’, ‘nervous’, lacking in ‘confidence’ compared with previous years;

2) Their decisions to spend are almost entirely determined by what’s happening here and now (unemployment, wages, inflation etc.) and they do not have a crystal ball and cannot see what is coming down the tracks as far as the economy and politics is concerned;

3) Retailers need to stop blaming their performance on consumer ‘confidence’ and instead focus on how to deal with the dramatic shift from physical stores to online, why their ranges or prices aren’t right or how they could improve their customer service or marketing. Jittery shoppers are, at the present time, mostly a figment of their imagination.